On September 18, 2023, the day before the Federal Open Market Committee meeting, Senator Rick Scott sent letters to three of the recently confirmed Federal Reserve Board of Governors members, asking for their commitment “to fix the Federal Reserve’s misguided path to date.”

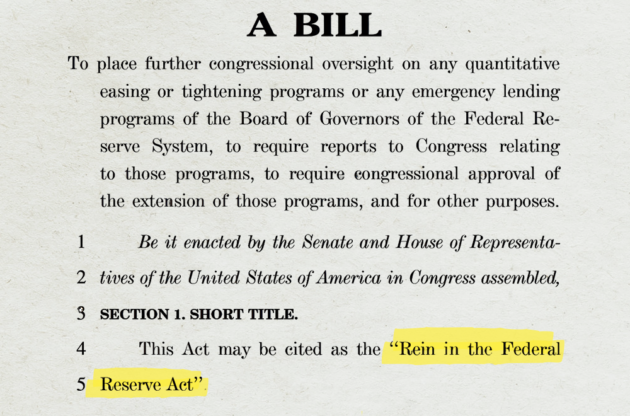

This follows extraordinary legislation he introduced on July 20, 2023, to “hold the Federal Reserve accountable.”

According to Senator Scott, “The lack of accountability and guardrails at the Federal Reserve have allowed the agency to make bad decisions with no consequences, growing its balance sheet to an unsustainable $8.3 trillion, making the Fed the largest agency, financially. Under Chair Powell’s leadership, the Fed has lost $1.3 trillion of your money just last year.”

“This legislative package puts forward comprehensive reforms to rein in the Federal Reserve, better protect taxpayer money and make sure the Fed is truly accountable to Congress and the American people.”

Why mainstream media is quiet about the Senator’s efforts to “rein in the Federal Reserve” is unknown.

But perhaps the media figured it wouldn’t make a compelling story because many Americans don’t know what the Fed does or how the Fed’s actions could affect their financial lives.

To answer those questions, let’s review the Fed’s original mission.

In 1913, authorities established the Federal Reserve for two reasons:

- Stabilize the U.S. banking system and…

- Ensure the nation could access money and credit.

Then, in 1977, Congress fine-tuned the Fed’s mission to include three more core objectives:

- Maximum national employment,

- Stable consumer prices, and…

- Moderate long-term interest rates.

Today, the Fed must balance these relatively new core objectives with its original mission. And sometimes, it means pitting one goal against another — like raising interest rates to fight inflation and stabilize prices, which is good… but it also reduces access to credit, which isn’t great.

It’s a complex situation. And although the Fed was created as a non-partisan, independent institution, the challenges it faces and the choices it must make are inextricably linked with the federal government.

For example, the national debt is now over $33 trillion — a problem plaguing the Biden Administration.

And who owns most of that debt?

According to Pew Research, “the Federal Reserve System is the single largest holder of U.S. government debt.”

And much of that debt was created when it “bought Treasuries in massive quantities during the COVID-19 pandemic in an effort to keep the U.S. economy from buckling under the strain of shutdowns and quarantines.”

So, the Fed may have helped to prevent economic collapse, but printing a massive amount of money to buy all those Treasuries triggered inflation, which burdens financial lives.

In other words, the solution created another problem.

In part, those Treasury purchases were supposed to help keep longer-term interest rates low to stimulate borrowing and spending — one of the Fed’s missions.

Now, the Fed has been raising interest rates to cool inflation and may continue to do so… which may tighten access to credit.

Round and round it goes.

Moving forward, the Fed is caught between a rock and a hard place… with a mission to spur economic growth while facing a challenge to lower inflation. And with an election on the way, it’s not hard to imagine how the Administration might want both victories on its record of accomplishments.

Which brings us back to the legislation against the Fed…

Scott and other Fed critics, like Ron DeSantis, believe political pressures may have eroded the Fed’s independent, non-political status and its ability to balance its core objectives to handle economic problems effectively.

As Forbes commented in April 2022, “Unfortunately, many folks currently at the Fed and recent nominees to key positions … seem increasingly interested in politics… [G]reater politicization will undermine trust in the Federal Reserve.”

Again, the mainstream news isn’t talking about the legislation.

But Washington is surely buzzing behind the scenes because…

Senator Scott’s “Rein in the Fed Act” is the third effort by US senators in the past year to hold the Fed accountable.

In December 2022, Senators Kevin Cramer and Pat Toomey introduced their Federal Reserve Accountability Act to address the Fed’s focus on “woke, environmental, social and governance matters”:

“This is not the job of the Federal Reserve. Our legislation reiterates Congressional oversight of the Fed, improves accountability, and protects our central bank from politicization,” said Senator Cramer.

Senator Toomey added, “This legislation will further that important goal by reforming the Fed to make it more accountable to Congress and the American people.”

But that’s not all…

In March 2023, following four major US bank failures, the bill was reintroduced by Senator Thom Tillis.

This brings us back to the present, where the Fed is grappling with multifaceted and increasingly complex economic challenges.

As the central bank navigates the tightrope of its responsibilities in this unprecedented macroeconomic environment, Senator Scott believes the Fed’s biggest challenge is lack of accountability because…

Currently, more than 30 federal agencies have a presidentially appointed, Senate-confirmed inspector general. But the Fed has none.

Only time will tell whether “politicization” of a Fed without oversight has affected its polices and whether it will influence its actions going forward.

But if the US Senators fighting to keep the Fed in check are correct, the central bank has veered from its original mission and found itself fighting against an economic situation it may have helped to create.

Or call 888-529-0399 to schedule a free consultation with an experienced Gold Specialist. There’s no obligation.